The dream of owning a stone crusher plant is an exciting one, pulsating with the potential to supply the essential aggregates that literally build our world. Yet, the pivotal question that gives every aspiring entrepreneur pause is a wonderfully complex one: "How much capital is truly needed?" The answer is not a neat, singular number placarded on a showroom floor. It is a vibrant, variable equation shaped by scale, ambition, and strategic foresight. Understanding the full capital stack—from the thunderous primary crusher to the last bag of cement for a foundation—is what separates a speculative purchase from a thriving, long-term investment.

Deconstructing the Capital Stack: From Machinery to Mobilization

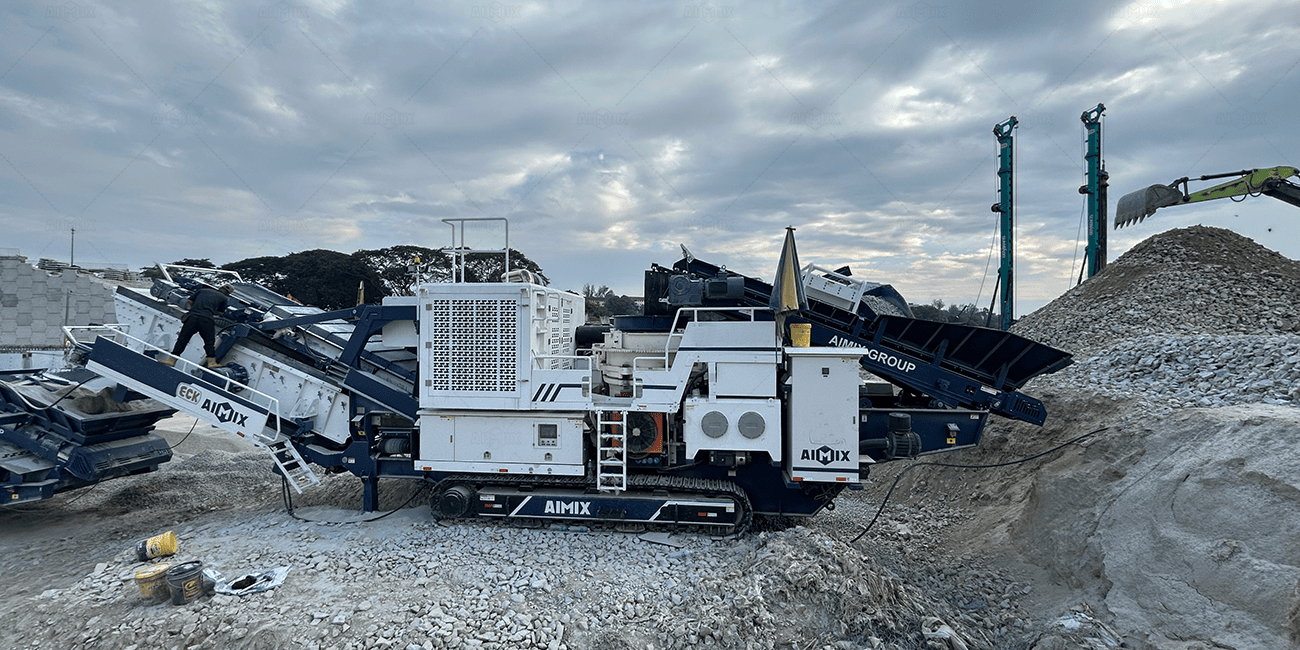

Let's dismantle the investment into its core components. At the heart lies the crusher machine itself, and here the cost spectrum is vast. A small, mobile jaw crusher capable of processing a few tons per hour might represent an entry point of $30,000 to $80,000. Stepping up to a medium-capacity plant featuring a primary jaw crusher and a secondary cone or impact crusher for better product shaping can easily command $150,000 to $500,000. For a full-cycle, stationary plant with multiple crushing stages, sophisticated screening towers, and conveyor systems, the machinery budget alone can soar from $700,000 into the multi-millions. But the crusher is merely the protagonist in a larger cast. Ancillary equipment—vibrating feeders, screens of various decks, conveyor belts, generators, and loaders—can constitute 30% to 50% of the total stone crusher plant cost. Then come the often-underestimated site works: land preparation, civil foundations for heavy machinery, electrical hookups, and drainage. One must also budget meticulously for the logistical ballet of shipping, customs clearance, installation, and commissioning by technicians, plus a crucial buffer of working capital to cover initial operations before revenue flows steadily.

The Analytical Framework: Modeling Your Specific Investment Scenario

This is where enthusiastic analysis becomes your greatest asset. Your capital need is directly dictated by your operational model. Begin with a clear-sighted input-output analysis. What is the nature and size of your raw feed material (hard granite, softer limestone)? What final products will you produce (¼” chips, ¾” aggregate, quarry dust)? Most critically, what is the verifiable demand in your target market? A mini-plant serving local housing projects has a fundamentally different financial architecture than a medium-scale plant supplying a regional road contractor, which in turn differs from a massive quarry operation feeding a major port construction. Model your scenarios. A $100,000 mobile setup might yield 50 tons per hour, while a $800,000 stationary crusher plant could deliver 200+ tons per hour. The calculus extends to running costs: fuel consumption, wear part replacement (those manganese jaws and cone liners are consumables), labor, and maintenance. Your capital requirement must account for the runway needed to cover these costs until the plant reaches its projected throughput and profitability.

Beyond the Purchase Price: The Pillars of Long-Term Viability

The most sophisticated, expensive plant will falter without foundational planning that doesn't appear on a machinery invoice. A robust business plan with detailed market research is a non-negotiable intellectual capital investment. The cost of regulatory compliance—environmental impact assessments, operating permits, community engagement, and health & safety protocols—is a critical line item, not an afterthought. These are investments in social license and operational continuity. Finally, your financing strategy will shape your capital reality. Will you use pure equity, seek equipment financing, or pursue a lease model? Each has implications for your initial outlay, cash flow pressure, and long-term balance sheet health. The goal is to align your funding structure with your projected revenue curve, ensuring you have the resilience to weather initial ramp-up periods.

Therefore, the essential capital for a stone crusher plant is a mosaic of tangible assets and indispensable planning. It is the sum of heavy steel and shrewd strategy, of diesel engines and detailed market analytics. By embracing this comprehensive view, you move beyond simply buying a machine to building a resilient, productive enterprise poised to capitalize on the unending demand for the bedrock of construction.